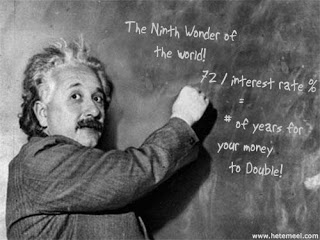

The Rule of 72 is a quick mental calculation, or a rough estimation, of the length of time, usually in years, for an amount to double given a fixed annual rate of interest. This is generally used for financial forecasts, especially in investments.

This rule applies the law of compounding interest. To explain, compounding interest happens when the interest earned on a principal is added to the principal so that the interest itself earns an interest.

To further illustrate the concept of compounding interest, say, for example, you invest 100,000 pesos in a bank account yielding 10%. By the end of the year, your ending balance on the account becomes 110,000 pesos. After two years, your money becomes 121,000 pesos and so on.

As a side note, take note that 10% on a regular savings or time deposit may be tough to find because banks generally only offer 1% to 4% on these types of accounts.

Now going back to the Rule of 72, consider the formula below:

x = 72/i

where:

x = number of years for an amount to double

i = interest rate

Dividing 72 by the interest rate, you get the number of years your money will duplicate itself. However, as noted in the definition of the rule above, take note that although it gives a quick rough estimate, the precision of the Rule of 72 diminishes the greater the rate of return.

Example #1:

Using the same amount and interest rate above, you invest your 100,000 pesos in a 10% time deposit, assuming there is one. Using the formula, the equation becomes:

x = 72/i

x = 72/10

x = 7.2

Your investment becomes 200,000 pesos after 7.2 years.

Example #2:

You want your money, 10,000 pesos in this case, to double after 5 years. Again, going back to the formula, we have:

x = 72/i

This time, since we already know you want your money to double in 5 years, we’ll substitute x with 5 and find the rate of interest to invest your money in:

5 = 72/i

Using the law of inversion, the formula now becomes:

i = 72/5

i = 14.4%

You’ll need an investment yielding 14.4% per year to double your money in 5 years.

Example #3:

In most developing countries, the Philippines included, average inflation rate is 5% to 6%. Using 6% as our going inflation rate, your 100 pesos today will lose half its purchasing power in 12 years.

x = 72/i

x = 72/6

x = 12

Example #4:

Most credit cards charge at least 3% for unpaid balances every month. 3% multiplied by 12 months is equal to 36%. In two years’ time, your credit card debt may become twice the original amount you owe, if you don’t pay in full and on time.

x = 72/i

x = 72/6

x = 2

The Rule of 72 may work for or against an individual, depending on whether the amount considered is invested or owed.

Latest posts by Maricel Rivera (see all)

- Creating a Working Environment in the Home - October 4, 2013

- Time Management is Life Management: When Life Gets Inundated by Time - June 16, 2013

- Speed Writing Is Not Rocket Science, Or Is It? - June 9, 2013

D ko masyadong gets 🙁 Sana nag aral ako ng business related course .. tsk tsk

Herbert, 72 divided by interest rate. Example, may utang ‘yong kapitbahay mo sa payday loans. Let’s say ang going rate is 10% per annum. 72/10 = 7.2. Meaning, kapag ‘yong kapitbahay mo, hindi nagbabayad ng utang, pagdating ng 7.2 years, doble na ng inutang niya ang babayaran niya sa payday loans. Ganoon din sa investments. Kapag nag-invest ka sa isang financial instrument na nagbibigay, for example, ng 12% rate of return. 72/12 = 6. In six years time, ang perang in-invest mo doble na. 😀

woooahh.. this is great.. this I have to remember thankee thankee.. now lets do some business hahahah

OnePack, hey, you’re welcome. I was glad to help!